CNN-News18

cayman islands

Caribbean Utilities Company (CUC) seeks court order to block release of costs report

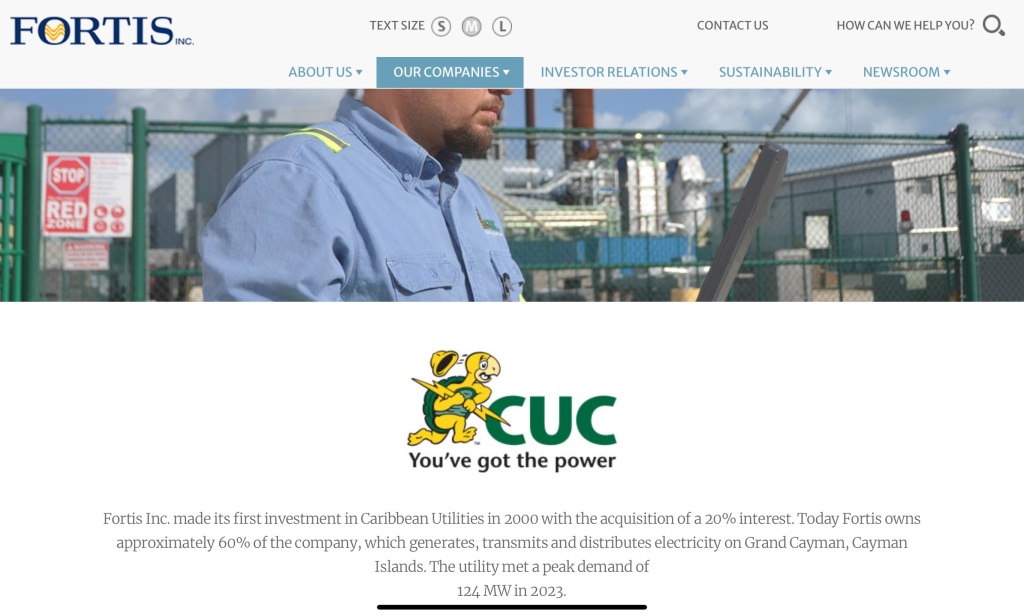

I shall attempt to unpack the Caribbean Utilities Companies situation here in the Cayman Islands, as well that of its majority shareholder Fortis Inc of Canada. https://www.fortisinc.com which owns at least 60% of Caribbean Utilities Company Ltd.

“Realise therefore, that over half of every dollar of Caymanians hard earned money ends up in the pockets of Fortis Inc. Shareholders.”

In fact, the total foreign ownership of Caribbean Utilities Company is in the vicinity of 81%.

FortisBC will Invest Close to $700 Million to Reduce GHG Emissions and Lower Energy Costs for Customers

Reducing energy use is a key pillar in the company’s goal to lead the clean energy transformation in BC Canada.

FortisBC will invest a record CA$694.8 million to help customers reduce their energy use over the next four years, a key pillar in the company’s goal to lead the clean energy transformation in B.C. The investment will allow FortisBC to shift its efforts to more advanced energy-efficiency initiatives, build new energy-saving programs and work with Indigenous communities to develop targeted programs for their unique needs.

It is indeed interesting to note the difference between Fortis Inc’s policies in Canada and their regional policies in The Cayman Islands, The Turks & Caicos Islands and Belize.

In British Columbia (BC) Canada FortisBC will invest CA$694.8 million to help customers reduce their energy use over the next four years, a key pillar in the company’s goal to lead the clean energy transformation in B.C.

In the Cayman Islands however Caribbean Utilities Company is seeking court action to block the public release of a pair of reports containing details of its costs and the capacity of the Cayman Islands power grid to add new renewable energy.

Public sector transparency watchdog, the Ombudsman, had ordered the release of the reports following a protracted Freedom of Information dispute.

In a ruling which also highlighted concerns over apparent conflicts of interest involving Grand Cayman’s monopoly utility company, the Ombudsman decided in February that the two documents should be released.

The differences in policy between the way customers are treated by Fortis Inc in BC Canada, and how they are treated in the Caribbean by their subsidiary Caribbean Utilities Company Ltd (as well as Fortis Inc’s Belize and Turks & Caicos operations) leads to only one possible conclusion which is that their Cayman Islands operation is exceedingly profitable, and that they will do everything possible to maintain their monoply. The fact that the cost of living in the Cayman Islands is the highest in the world is obviously meaningless to the management of Caribbean Utilities Company as they are at heart Capitalists whose only care is Fortis Inc shareholder profits.

Caribbean advocate: Cayman voiceless in international climate-change talks – Cayman Compass

Fletcher told the audience that when he was negotiating with Amber Rudd, when she was the UK’s minister for climate change, “she was fighting me on loss and damage because loss and damage meant liability and compensation, which is something that the United Kingdom did not want to consider.

“But, for you in Cayman, loss and damage is important, so who speaks on your behalf now?”

Atlantic at Tipping Point

The Atlantic is calculated to rise by a metre. Photo: Henrik Egede-Lassen This is Climate Crisis article Number 26. A study finds the circulation of …

Atlantic at Tipping Point

‘Conflict of interest’ concern over CUC’s renewable energy bid links – Cayman Compass

Concerns have been raised over conflicts of interest for Grand Cayman’s monopoly utility company CUC as the island attempts to accelerate its transition to renewable energy.

The Ombudsman – Cayman’s public sector complaints watchdog – has flagged potential challenges with the bid process for large-scale solar projects.

“It appears that one bidder (CUC), which already holds a monopoly position in terms of the sale of electricity, is co-designing the specifications of the request for proposal for an upcoming bidding process, in which they, themselves, will be an interested party,” Ombudsman Sharon Roulstone wrote in a hearing decision on a related freedom of information dispute.

“In my mind, this has the appearance of a conflict of interest.”

Switzerland has lost 10% of its glaciers in the last two years

‘Dramatic’ acceleration: Switzerland has lost 10% of its glaciers in the last two years https://www.euronews.com/green/2023/09/28/dramatic-acceleration-switzerland-has-lost-10-of-its-glaciers-in-the-last-two-years

Democracy & Good Governance In The Cayman Islands

Vision 2030: A New National Strategic Plan 2020 – 2030?

- Do you want a more affordable cost of living?

- Do you believe that the government should be building affordable housing for Caymanians?

- Do you want to see the environment protected?

- Do you want your electrical (CUC) bill to be lower?

- Do you find your health insurance very costly?

Port plan to undergo economic impact assessment

An economic impact assessment for the proposed cruise berthing facility is in the works, The Cayman Reporter understands.

Minister of Finance Hon Marco Archer confirmed that PricewaterhouseCoopers (PWC) has been contracted to carry out the assessment. The Cayman Reporter inquired if the assessment has already started and how much this assessment will cost the country, but Mr Archer has not responded at press time.

The Cayman Islands has already done an Environmental Impact Assessment (EIA) to the tune of $2.5 million based on the current proposal of a two finger pier. The EIA indicated that dredging and its silt plume could impact 15 acres of coral reef. Now that the EIA has been completed and the Department of Environment (DoE) is the process of completing a report on the assessment to submit to Cabinet, a call for the examination of the proposal’s impact on the entire economy has been made.

Founder and Director-General at The Cayman Institute, Nicholas Robson, said to grasp the full impact of the proposal its impact on the country’s economy must be evaluated. He believes the economic impact assessment should state how financing a cruise port, that could destroy a significant part of the reef on the south-west of the island, will affect the country. He believes it should look at how many jobs will be affected in the retail sector as well as in to water sports industry.

He noted that it is also imperative to analyse the true strengths and weaknesses of the cruise tourism and stay-over tourism to these islands.

“We should be weighing up the cruise passenger industry and its per-capita spend against stay-over tourism. Should we be looking into lengthening the runway to 10,000 feet to be able to accommodate long haul flights from Europe and points east? The Persian Gulf and China have many high net worth individuals which may well want to come to the Cayman Islands. We have already had Mr. Lee Ka-Shing one of the richest men in Hong Kong residing and doing business here,” he said. Furthermore, Mr Robson stated that it is important for Cayman to know how many cruise passengers it can manage. “If we try and take too many cruise passengers per day none will have an enjoyable experience,” he said.

Commenting on his own stance on the port plans Mr Robson said he is for any initiative that will have the greatest benefit to the majority of the people in the Cayman Islands. “A decision made today will affect the Cayman islands for many years into the future. Furthermore, with Cuba opening up the cruise industry may find that more passengers want to go to Cuba, causing some of the cruise lines dropping Cayman,” he said.

The Advancement of Cruise Tourism in the Cayman Islands (ACT) member Chris Kirkconnell told The Cayman Reporter that the ACT was formed because members involved in the cruise industry felt that the Cayman Islands Tourism Association (CITA), the tourism sector’s representative group, was only concerned about stay-over businesses. Those involved in cruise felt that in order to have a voice they had to start a group of their own.

“Once we formed ACT CITA tried to convince us that we didn’t need a separate entity and it seemed like they were trying to give us some kind of attention up until now. If you look at the member makeup of CITA its much more heavily stay-over focused than cruise,” Mr Kirkconnell expressed. More

A Fossil Fuel Free World is Possible: How to Power a Warming Earth Without Oil, Coal and Nuclear

“There’s all sorts of, kind of, false beliefs about renewable energy, but things have changed. Wind is, right now, not only one of the fastest — between wind and solar — are the fastest growing new sources of electric power in the United States, but wind is actually the cheapest form of electricity by far in the U.S. today.

The unsubsidized cost without the subsidies is about 3.7 to five cents per kilowatt hour. Subsidies are another 1.5 cents to drop those costs per kilowatt hour. That compares with natural gas which is six to eight cents per kilowatt hour. So wind is one half the cost of natural gas. Utility scale solar is about the same as natural gas now; it’s also around six to eight cents per kilowatt-hour unsubsidized.”

Well, it turns out that people today can actually control their own power in their own homes. You can put solar panels — I mean wind turbines may be only in a few locations in your back yard, but you can combine solar panels on your roof top with batteries and Tesla has a new battery pack that you can put in your garage that can — where you can store electricity during the day that from the solar, and then use it — use that electricity when there are peak times of electricity because that is when the price is much higher. But people can do other things. They can weatherize their home, they can use energy efficient appliances. There are a lot of things that people can do to reduce energy use and go towards 100 percent renewable energy. Using heat pumps instead of gas heaters. Getting electric cars instead of gasoline cars. More