Offshore financial centers owe their prosperity to tax transparency, not tax evasion

Grand Cayman, Cayman Islands — January 13, 2015 – Cayman is prosperous, in part, because of a great global lie, which causes many big rich nations to pursue bad economic policies. The global lie is that the developed countries have too little government, rather than too much

That lie causes countries to tax themselves far above the level that would maximize the general welfare and job creation. That lie causes governments to spend money on many nonproductive activities and to spend money far less efficiently than the private sector for the same activity. Finally, that lie causes governments to regulate excessively and often in a destructive manner. The simple and obvious empirical fact that most developing and developed countries with smaller government sectors have grown faster in recent decades than those countries with big government sectors is ignored both by the politicians and many in the media

The Economist magazine is just out with its annual lists of economic forecasts for the major developed countries. It makes for depressing reading. The euro area (including Germany, France, Italy and Spain) and Japan had less than 1 percent growth in 2014, and are forecast to average only about 1 percent growth in 2015, which is little more than stagnation. Britain and the United States are doing the best — having growth of about 2.9 percent for Britain and 2.3 percent for the United States in 2014 — with a forecast of approximately 3 percent growth for both in 2015. These numbers are all well below the averages for the great prosperity that lasted for the 25-year period from 1983 to 2007. The unemployment rate for the eurozone at the end of this past year was 11.5 percent (depression levels)

The political classes in these countries, rather than taking responsibility for their own misguided policies, look for scapegoats. Their favorite scapegoats are high-growth countries with low tax rates on savings and investment. They blame offshore financial centers like Cayman, Hong Kong, Bermuda, and even mid-sized countries like Switzerland for engaging in “unfair tax competition.

Critics of Cayman and other offshore financial centers call them “tax havens,” ignoring the fact that they all have many taxes, particularly on consumption — which is good tax policy — rather than on productive labor and capital — which is bad tax policy. The statist political actors in the high-tax jurisdictions will not admit that people do not work, save and invest if they are going to be overly taxed and otherwise abused by their own governments. Those who are able will pick up some of their marbles and move them to places where they will be better treated.

Cayman and other offshore financial centers originally arose because of a need to have places that facilitate the movement of marbles (aka savings). Cayman is too small (only 100 square miles and 50,000 people) to be the ultimate destination of wealth trying to escape oppression — but it has the rule of law, an honest court system and protects private property — which allows it to become a protected way station for productive investment throughout the world, including the United States.

Cayman now has almost total tax transparency with the United Kingdom, the European Union and the United States as a result of tax information exchange agreements; yet its financial sector continues to grow — more company licenses, more of the world's hedge funds (with total assets of almost $2 trillion), and more insurance companies. This growth is not driven by tax evasion, but mainly by regulatory and civil court efficiency and integrity

The chairman of the Cayman Islands Stock Exchange, Anthony Travers, recently wrote in the IFC Review: “Paradoxically, what now becomes clear as a result of this increased tax transparency is that the historical arguments of the NGOs [non-governmental organizations] in relation to the extent of tax evasion in the offshore jurisdictions are proven to be the purest nonsense. Not only have the Tax Information Exchange Agreements failed to generate any discernible revenue but what will now be shown is that the tax revenues generated for the benefit of the USA and the U.K. Treasuries from FATCA [Foreign Account Tax Compliance Act] will be marginal.”

The fact is the world would be poorer with even less growth if the offshore financial centers did not exist — because the amount of productive investment and its efficient allocation would be less. The offshore centers are merely a response to bad tax, regulatory and spending policies in most of the major, rich countries. The major countries could conquer the offshore centers, but as the smart people know, that would make the rich countries poorer, and without a convenient scapegoat. Or, the rich countries could reduce the size of their own governments, cut tax rates on capital, and make their regulatory systems cost-efficient. Such actions would reignite growth and job creation — but reduce the power of the political and international bureaucratic classes — so they continue the big lie.Richard W. Rahn

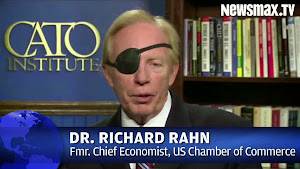

Richard W. Rahn is a senior fellow at the Cato Institute and chairman of the Institute for Global Economic Growth.

http://www.washingtontimes.com/news/2015/jan/12/richard-rahn-cayman-islands-owe-prosperty-to-trans/